The Transformative Impact of Reality Data Capture in the Insurance Industry

In recent years, the insurance industry has increasingly turned to advanced technologies like reality data capture to enhance its operations. Utilizing drones, LiDAR, and high-resolution imagery, reality data capture provides precise and comprehensive data that can significantly improve various aspects of the insurance process. From underwriting to claims processing, this technology is reshaping how insurance companies assess risk, manage claims, and service their clients.

Applications of Reality Data Capture

Due to cost considerations, drones for insurance inspections are predominantly used in the commercial field. High-value homes and commercial properties are the primary targets because their average premiums justify the expense of a (minimum) $350 drone flight. In contrast, typical residential premiums of around $1,200 per year do not make this technology cost-effective for standard home insurance.

Specific Scenarios:

- Pre-underwriting: Insurers use imagery to assess new policies within the initial 45-60-day period. This helps them make informed decisions about accepting or rejecting policies based on the initial risk evaluation.

- Roof Claims: Assessing roof conditions is a major application, as roof claims constitute a significant portion of insurance claims. Accurate drone imagery can determine the state of a roof more efficiently and safely than manual inspections.

- Loss Control Inspections: Periodic inspections using drones for re-underwriting purposes. Insurers might re-evaluate a policy before renewal by conducting thorough inspections, including drone flights for roof assessments. This ensures the continued suitability of the policy and helps in identifying any new risks.

Claims Processing

Streamlining Workflow: Reality data capture technology significantly speeds up the claims process and increases safety and efficiency.

Advantages:

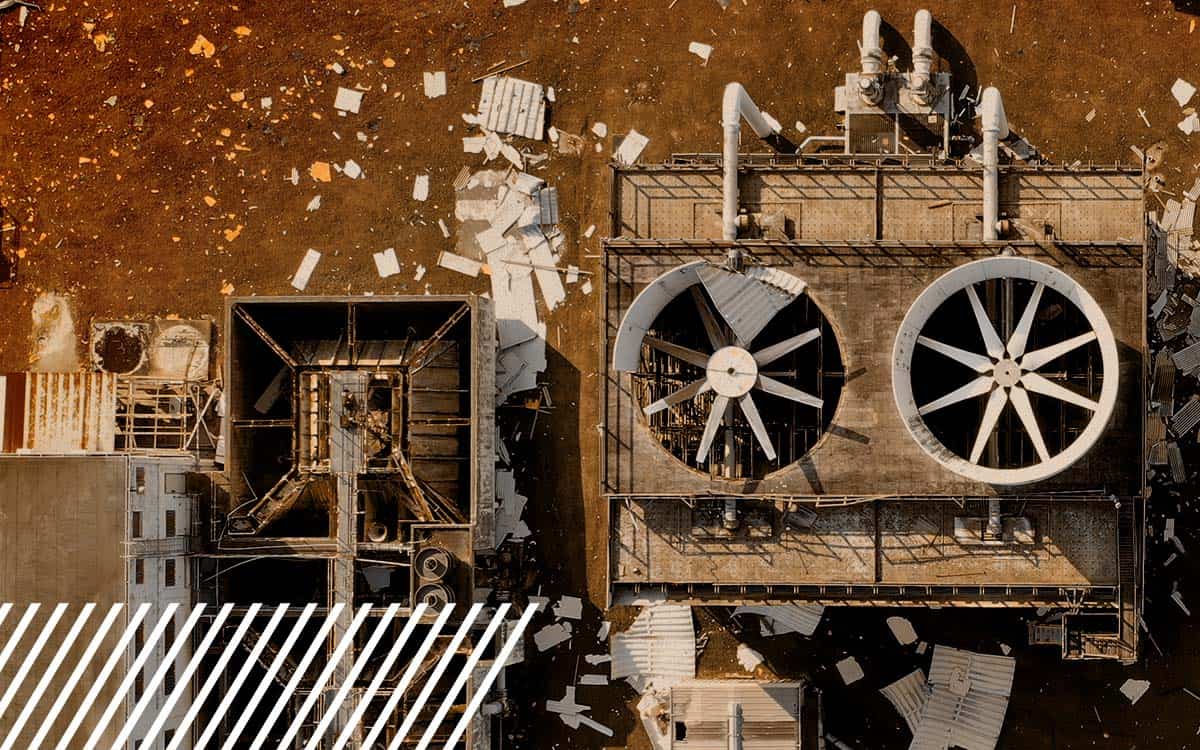

- Safety: Drones reduce the risk associated with manual inspections in hazardous locations, such as high-steepled churches or expansive manufacturing plants.

- Efficiency: Quick assessments allow for comprehensive inspections of large areas within a day, improving turnaround times and reducing labor costs.

Risk Assessment

Reality data capture enhances the ability to make informed risk selections, particularly beneficial for high-value or high-risk properties. Detailed and accurate data helps insurers better understand and manage potential risks.

Underwriting

Utilizing accurate and detailed data collected through reality data capture aids in making well-informed underwriting decisions. The types of data collected include high-resolution images, 3D models, and precise measurements, all of which are critical in evaluating a property’s insurability.

Fraud Detection

Using historical and current imagery helps identify fraudulent claims. In one instance, pre-existing damage to a roof was identified using drone imagery, preventing a fraudulent claim that could have cost the insurer significantly. By verifying that the damage existed prior to the claimed event, the insurer saved millions of dollars.

Disaster Response

Drones can be deployed quickly in post-disaster assessment damage in areas inaccessible due to disasters. This rapid deployment aids in faster claim processing and recovery.

- Preparedness and Mitigation: Insurers can plan and mitigate potential disaster impacts by using drone imagery to evaluate risk and damage.

- High-Value Homes: For clients with multiple high-value properties, drones can proactively capture imagery to assess potential losses, even if the homeowners are not present.

Benefits of Reality Data Capture

Accuracy and Efficiency

Reality data capture offers numerous benefits to the insurance industry, particularly in terms of accuracy and efficiency. Enhanced precision in data collection leads to better assessment and decision-making, while the use of drones and other reality data capture tools significantly reduces the time and costs associated with manual inspections, resulting in faster claim resolutions and overall cost efficiencies.

Customer Experience

The impact on customer experience is also substantial, as quicker claims processing and settlement enhance customer satisfaction. Many customers have positively remarked on the safety and speed provided by drone-assisted assessments.

Operational Challenges

However, operational challenges exist, such as doubts about data accuracy, logistical issues, and pilot availability. Strategies like educating stakeholders about the accuracy of drone data and ensuring an adequate number of trained pilots can mitigate these challenges.

Integration with Existing Systems

Integration with existing insurance IT systems is another benefit, as reality data capture tools facilitate seamless data transfer and analysis. Specific tools and platforms can further enhance this integration, allowing for detailed analysis and better-informed decision-making.

Regulatory Compliance

Regulatory compliance is also crucial, with the current landscape and future standards, especially regarding AI, requiring careful navigation. Best practices for maintaining compliance include staying updated with regulations and implementing robust compliance measures when leveraging reality data capture technologies.

Future Trends

AI will play a significant role in enhancing data capture and analysis, providing deeper insights and improving decision-making processes. As AI and other technologies evolve, they will further shape the future of reality data capture, making it an even more integral part of the insurance industry.

To learn more about choosing the right reality data capture partner read our blog on eight key factors to consider when choosing a partner.

Real-World Implementation

Case Studies

Significant Impact Examples: In one notable case, an insurer saved over $8 million in one year by using drone imagery to deny fraudulent roof claims, compared to the previous year’s average roof claim cost of $350,000.

Measurable Outcomes: The insurer’s $300,000 investment in drone contracts yielded substantial savings and operational efficiencies, demonstrating the value of reality data capture.

The Future of Insurance: Embracing Reality Data Capture

Reality data capture is revolutionizing the insurance industry by providing accurate, efficient, and cost-effective solutions for risk assessment, claims processing, and fraud detection. As technology continues to evolve, its integration into insurance operations will only deepen, offering even greater benefits. Insurers should consider the potential of reality data capture for enhancing their operations. By leveraging this technology, insurance professionals can improve their risk assessments, streamline claims processes, and deliver better customer experiences. Explore how reality data capture can transform your insurance practices today.