Across the insurance industry, companies are reevaluating traditional processes and adopting new technologies to enhance speed, accuracy, and trust. One of the most transformative tools now in widespread use is drone technology. From roof inspections for insurance claims to comprehensive property assessments following natural disasters, insurance companies utilizing drones are gaining a competitive edge through faster, smarter decisions backed by visual data.

Integrating Drone Data into Insurance Workflows

Insurance carriers are increasingly adopting drones for insurance inspections to support risk assessment, underwriting, and claims management. With seamless API integrations, high-resolution aerial imagery and orthomosaics are now flowing directly into claims platforms, allowing insurers to work more efficiently without overhauling their entire systems.

Jessica Morse, a sales leader and insurance industry go-to at FlyGuys, explains, “Drones are being used across the policy lifecycle, from initial property assessments to post-storm inspections. With API integration, insurers don’t have to reinvent the wheel to start using drone data.”

This means carriers can capture real-time property visuals without sacrificing their existing operational workflows. The result: improved data flow, reduced delays, and fewer manual bottlenecks.

Why Drone Data Matters for Underwriters and Adjusters

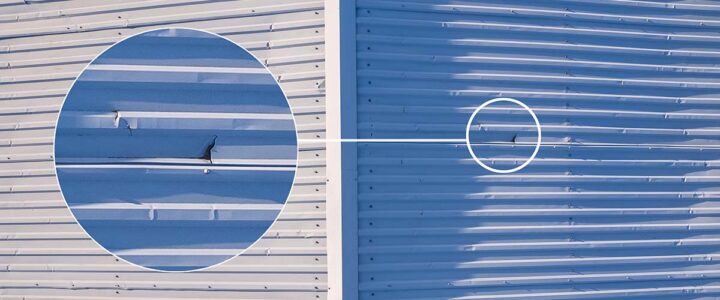

Insurance drone inspections offer a bird’s-eye view of properties, revealing details that might be missed from the ground. This aerial perspective is especially valuable for roof and exterior inspections, where safety risks and access limitations often complicate traditional assessments.

For underwriters, current imagery enhances risk evaluation by documenting roof conditions, structural wear, and nearby hazards. For adjusters, drones reduce the need for physical roof access and provide better coverage of complex sites.

Luke Adams, who works closely with insurance customers at FlyGuys, says, “Photos, videos, and orthos give adjusters a true top-down view. It’s like giving them a new set of eyes, one that doesn’t miss the details.”

Whether it’s identifying hail damage or verifying previous repairs, drones ensure adjusters work with complete, accurate data from the start.

AI and Drone Data: A Smart Combination

When insurance drone data is processed through artificial intelligence, its value multiplies. AI algorithms trained to detect storm damage, moisture intrusion, and missing shingles can process thousands of images in minutes, flagging risks that the human eye might overlook.

This enables insurers to automate a significant portion of the claims review process, improving accuracy while reducing labor costs. Many companies are now connecting drone imagery directly to platforms like Xactimate via API, allowing for automated measurements, cost estimates, and claim validation.

As Jess puts it, “AI lets you go beyond seeing damage. It helps you understand what caused it. Whether it’s hail, wind, or normal wear, insurers can make better decisions backed by data.”

A Real-World Example: Roofing Contractors and Drone Inspections

Beyond insurance companies, roofing contractors are also benefiting from the use of drone technology. Luke shared a story from his cousin, who owns a roofing business and now uses a single drone to scan entire roofs.

This enables the team to identify which sections require repair and generate accurate quotes quickly. Instead of replacing an entire roof, they target specific areas, saving money for clients and improving efficiency.

This type of insurance drone inspection doesn’t just help roofers, it creates a reliable, shared visual record for both contractors and insurance providers. That’s a win-win for claims accuracy and customer satisfaction.

Fighting Fraud and Reducing Human Error with Reality Data Capture

One of the biggest advantages of using drones for insurance inspections is the reduction in fraud and human error. When insurers can compare pre- and post-event imagery of a property, they can easily validate whether damage is new or pre-existing.

Time-stamped and geolocated visuals provide a tamper-proof audit trail, making it easier to verify claims and reduce disputes. For insurance adjusters, this eliminates reliance on subjective reporting and creates a higher standard of accountability.

Drones also help reduce liabilities associated with manual inspections, especially when it comes to roof access. Adjusters can gather the data they need without climbing ladders or walking on potentially unstable structures.

Empowering Policyholders with Drone Inspections

It’s not just insurance companies that are leveraging drone data. Many homeowners and property managers are now requesting their own insurance drone inspections to support claims or establish baseline property conditions.

This gives policyholders greater control and transparency when navigating a claim. By providing their insurer with independent aerial imagery, they can validate the timing, location, and extent of the damage, often speeding up the claims process and avoiding underpayment.

Luke notes, “We’re seeing customers proactively order their own scans. They want a clear record to support their side of the claim.” As insurance expectations evolve, tech-savvy policyholders are becoming active participants in the process, armed with data that’s difficult to dispute.

The Future of Drone Use in Insurance

So, do insurance companies use drones? Absolutely—and those that don’t soon will. The demand for faster claims, improved safety, fraud reduction, and automated workflows is pushing drones for insurance claims into the mainstream.

Companies that invest now will gain a significant competitive advantage. Those who wait risk falling behind in an industry that increasingly values speed, precision, and transparency.

Let’s Talk About Your Next Insurance Mission

FlyGuys provides nationwide drone services designed for the insurance industry. Whether you need post-storm roof imagery, AI-ready thermal scans, or full-property orthomosaics, our network of professional drone pilots delivers reliable, scalable data solutions.